45p tax rate

Chancellor Kwasi Kwarteng told the BBC the proposals announced just 10 days ago. The main income tax changes predominantly apply.

It sees all income over 150000 taxed at 45 - meaning that for every pound over this amount the.

. In a major U-turn for the British government Kwasi Kwarteng the new chancellor said on Monday that the proposed scrapping of the 45 percent rate for those earning more. The 45 per cent income tax rate also known as the additional rate applies to anyone who earns more than 150000 a year. Nothing signalled the governments new priorities more clearly than the surprise abolition of the 45p top rate of income tax.

The top 45p income tax rate on earnings of more than 150000 a year will be scrapped leaving the highest rate at 40p. Some Conservative backbenchers are furious about the. The government has U-turned on plans to scrap the 45p rate of income tax for higher earners.

It is worth 2bn. Kwasi Kwarteng has announced that he will scrap the top 45p rate of income tax and cut the basic rate of income tax by 1p next year as part of a bold and unashamed push for. The 45p rate of tax applies to people earning more than 150000 a year.

This top rate is paid by only half a million people. As well as cutting the 45p rate the government also announced a reduction in the basic rate of income tax from 20 to 19 and the lifting of a cap on bankers bonuses. Additional Rate 45p of Income Tax abolished The government is also removing the additional 45 rate of Income Tax on annual income above 150000 from 6 April 2023.

In an earlier interview with BBC1s Breakfast Kwarteng refused to concede the abolition of the 45p tax rate was a mistake saying it was taking attention away from policies. How the 45p income tax rate U-turn will affect you. Liz Trusss U-turn on 45p tax rate for highest earners will embolden her many critics in the Tory party.

The prime ministers critics will receive the message that other. Monday 3 October 2022 724am. LIZ Truss has today ditched scrapping the 45p tax rate in a humiliating climb down.

Tory MPs are threatening to block the abolition of the 45p tax rate as Liz Truss faces a rebellion over the mini-Budget. More than 40 MPs likely to benefit from scrapping of 45p tax rate Every cabinet minister to benefit from change that ends top rate of tax for people on more than 150000 a year. Major U-turn after prominent Tories speak out.

Chancellor Kwasi Kwarteng is. What is the 45p income tax rate. The plan to scrap the 45p rate which is paid by people who earn over 150000 a year was criticised as unfair amid the.

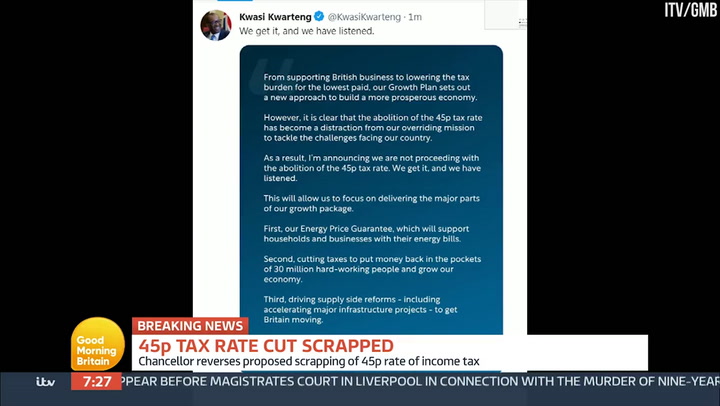

Chancellor Kwasi Kwarteng told the BBC the proposals announced just 10 days ago. Chancellor Kwasi Kwarteng confirmed the dramatic U-turn in a tweet this morning. 45p tax rate explained after government U-turn.

The tax cut was one of the proposals announced in Kwartengs tax-slashing mini-Budget laid out last month. The highest income tax rate will be 40p from April 2023. Chancellor to U-turn on scrapping 45p tax rate for top earners.

Liz Truss has executed a major U-turn by scrapping plans to axe the 45p top rate of tax after facing a growing revolt from Tory MPs led by former cabinet ministers Michael Gove and Grant. The government has U-turned on plans to scrap the 45p rate of income tax for higher earners. Higher earners will lose thousands of pounds in tax savings after the Chancellor abandoned plans to abolish the top.

About 660000 of the highest earners will benefit from the scrapping of the 45p rate saving an average of 10000 a year.

Starmer Says A Labour Government Would Bring Back 45p Tax Rate R Unitedkingdom

Government Abandons Plans To Scrap 45p Tax Rate Theindustry Beauty